The Tax Office database is updated every year from information supplied by HMRC.

From the Main Details screen selecting the drop down arrow to the right of the Tax Office box brings up a list of Self-Employed (SE), Corporation TAX (CT) and PAYE (PY) offices in district number order.

Scroll down the list to highlight the relevant district and select it.

Clicking on the ellipsis (...) to the right of the district number enables you to add, delete or edit a tax district's details.

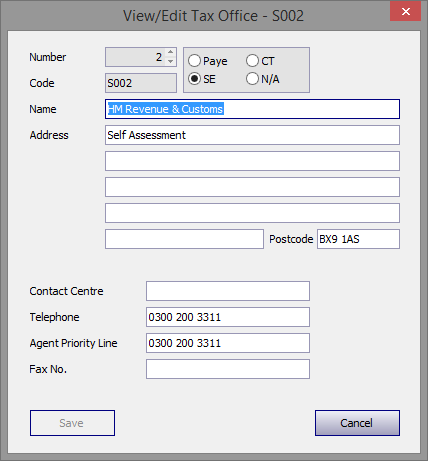

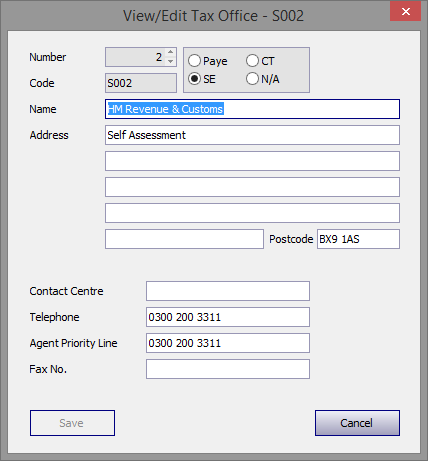

To view or make changes to the full details of a particular office highlight the district concerned and click on the View/Edit button.

To delete then reset all tax office records to the default database click on the reset db button. Be aware that doing this will lose any changes you may have made to a tax office(s) since the program was installed.

Copyright © 2025 Topup Software Limited All rights reserved.